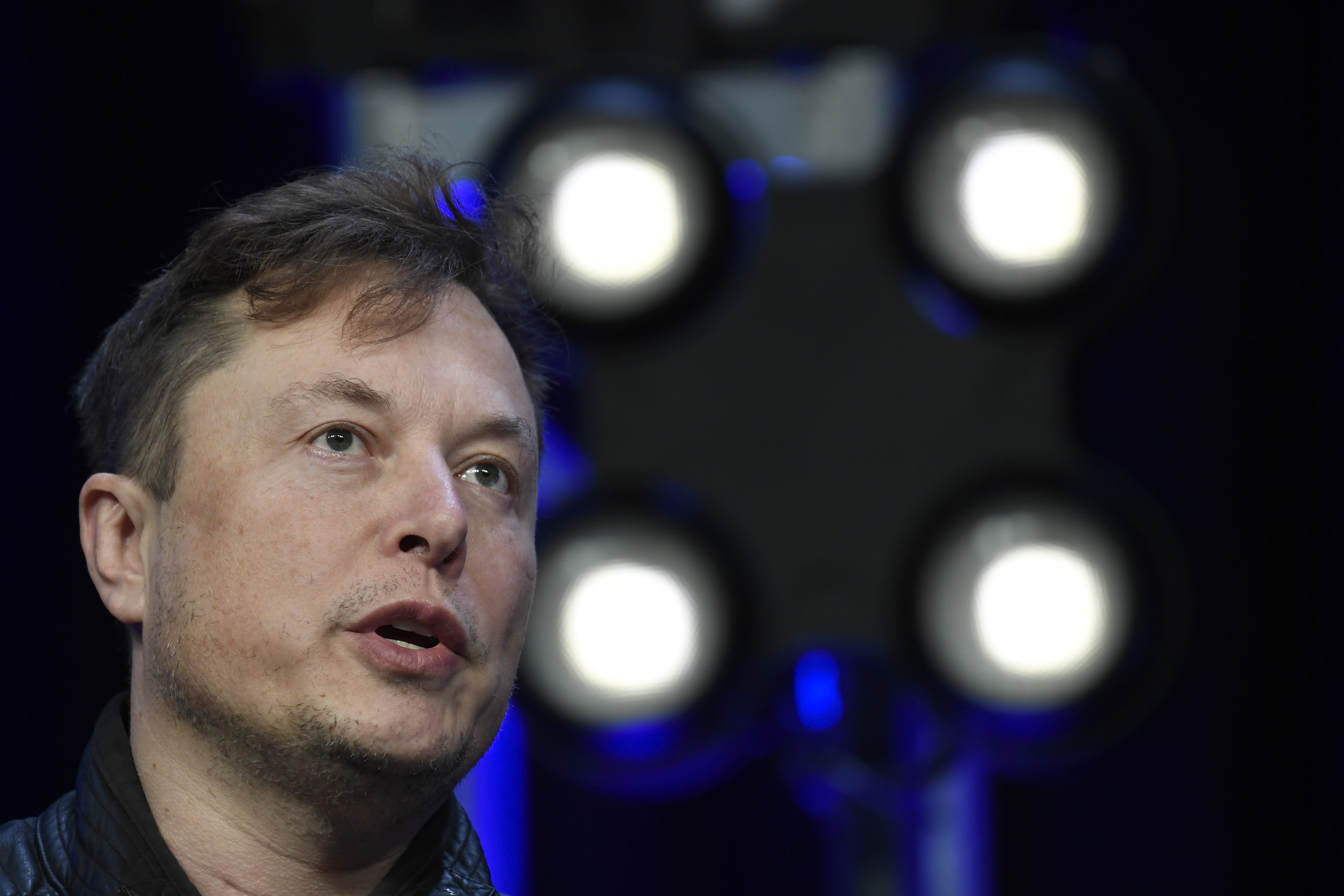

Twitter has agreed to sell itself to Elon Musk in a deal valued at around $44 billion (A$61 billion), the company said Monday.

The deal caps off a whirlwind news cycle in which the Tesla and SpaceX CEO became one of Twitter's largest shareholders, was offered and turned down a seat on its board and offered to buy the company — all in less than a month.

The deal comes after Mr Musk revealed last week he had lined up $46.5 billion (A$64.9 billion) in financing to acquire the company.

Twitter's board met on Sunday to evaluate Mr Musk's offer.

READ MORE: Man returns from shops to find wife and baby killed

Mr Musk said on Twitter on Monday that, "I hope that even my worst critics remain on Twitter, because that is what free speech means."

The deal would put the world's richest man in charge of one of the world's most influential social media platforms.

READ MORE: World's oldest person, Kane Tanaka, dies in Japan

Mr Musk has repeatedly stressed in recent days that his goal is to bolster free speech on the platform and work to "unlock" Twitter's "extraordinary potential."

"I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy," Mr Musk said in his offer letter to Twitter.

"However, since making my investment I now realise the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company."

In the days following Mr Musk's bid, Twitter's board put in place a so-called poison pill that would make it more difficult for Mr Musk to acquire the company without its approval. There were also questions about whether the company would try to find another buyer.

However, CFRA senior equity analyst Angelo Zino said on Monday that Twitter's board more seriously considering Mr Musk's offer may have come "from the Board's realisation that an alternative bid from a 'white knight' may be difficult to come by, especially following the decline in asset prices from social media companies in recent weeks/months."

Source: https://ift.tt/UOrwBNX

Comments

Post a Comment