Australia's stock market has been rocked for the fifth day in a row, dropping more than 3 per cent in minutes as the market opened.

At 10.10am AEDT the benchmark S&P/ASX200 had fallen 219 points or 3.3 per cent, instantly wiping approximately $50 billion from the market.

It's the fifth day in a row that the market has dropped, wiping off approximately $200 billion from the market and erasing all gains made in 2020.

READ MORE: How to spot the symptoms of coronavirus

Investors scrambled to dump money from Australian stocks the morning after PM Scott Morrison announced he was activating an emergency plan in anticipation of the coronavirus outbreak reaching a pandemic phase.

Mr Morrison said the plan was triggered to "contain the impact of this virus".

"Together we will get through this," he said.

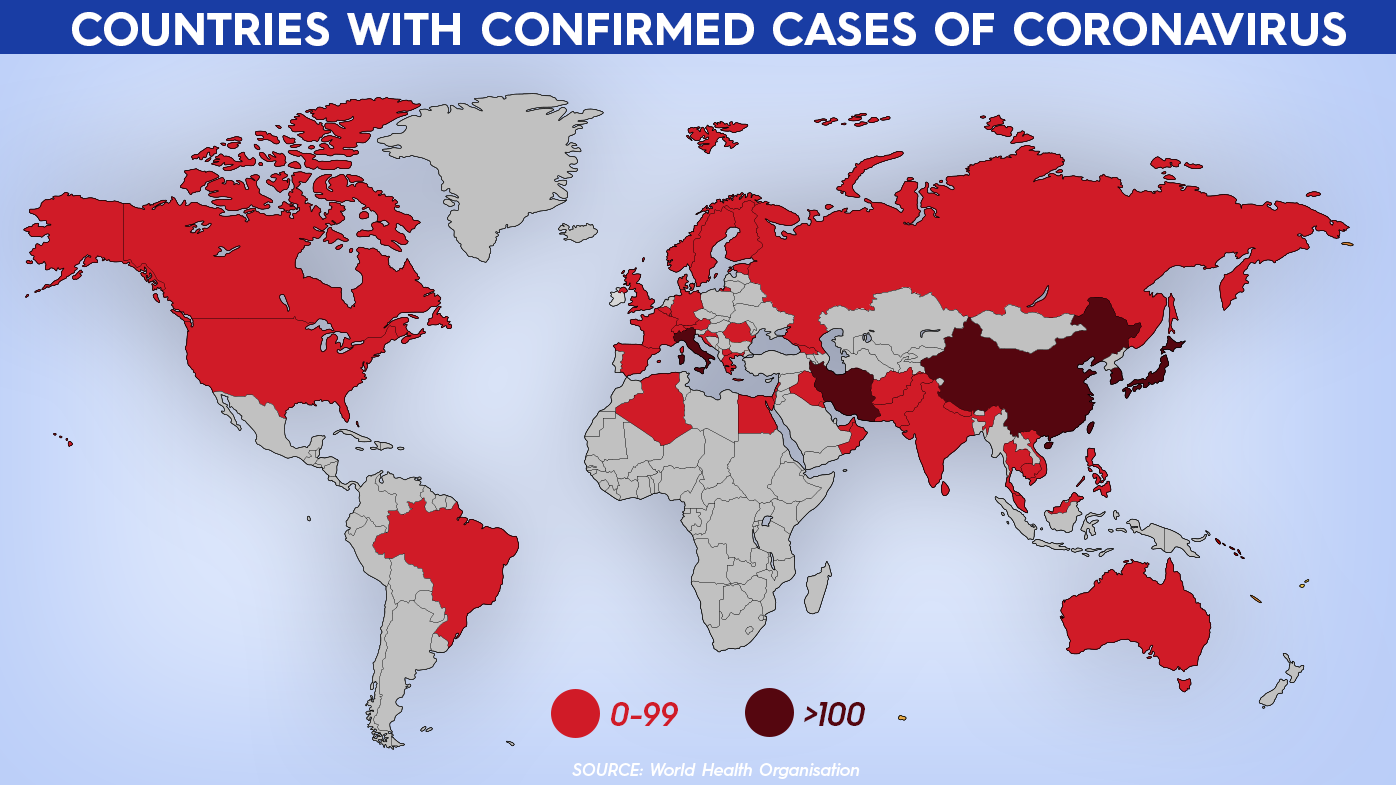

The World Health Organisation has not yet declared the COVID-19 outbreak as a pandemic, but Mr Morrison said based on "expert medical advice" the government has taken "steps necessary" to contain the pandemic.

PANDEMICS THROUGH HISTORY: How disease has rocked humanity throughout the ages

WHY MARKETS ARE PLUNGING

Earlier this week more than $1.5 trillion was wiped off the global economy as investors pulled their cash from volatile markets and pushed it into traditional "safe havens" such as gold.

Investors are worried about the coronavirus outbreak – not because they are moral pundits wishing for world health – but because a disease pandemic means trade is restricted.

Australia is currently one of the biggest exporters of iron ore and coal to China. It's estimated just shipping iron ore to China is worth $120 billion a year to Australian businesses.

READ MORE: Supermarkets, chemists sell out of sanitisers as coronavirus fears intensify

An outbreak of a disease like coronavirus puts ship captains on docks, closes ports, ceases truck delivery routes and effectively puts a stop jamb in the rive of money from Aussie mines to Chinese manufacturers.

In Prime Minister Scott Morrison's words: "When planes aren't coming in, planes aren't going out".

READ MORE: Coronavirus could combine with flu to create mega Australian winter health crisis

WHAT DOES THIS MEAN FOR ORDINARY INVESTORS?

Day-to-day booms and busts of the world's stockmarkets should do relatively little to your average mum and dad investor, largely because of the size of the stake they may hold.

To put the ASX's current plunge in context, the market is now back to where it was in mid-January 2020. It's effectively only erased a month and a half of value gained.

Effectively all businesses that trade outside of Australia will be affected by delays caused by the coronavirus in some way.

READ MORE: Students from Prince George and Princess Charlotte's school in isolation amid coronavirus fears

These delays mean companies may have to withhold paying a dividend to investors (effectively returning profits to shareholders).

As most ordinary mum and dad investors do not rely on the market as their sole source of income, the payment of dividends is simply par for the course of "playing" the stock market.

Source: https://ift.tt/2vdExNW

Comments

Post a Comment